Find helpful customer reviews and review ratings for Quicken For Mac 2016 Personal Finance & Budgeting Software. Quicken For Mac 2016 Personal Finance & Budgeting Software [Old Version] by Intuit, Inc. Platform: Mac Disc Change. And I really want.

Find helpful customer reviews and review ratings for Quicken For Mac 2016 Personal Finance & Budgeting Software. Quicken For Mac 2016 Personal Finance & Budgeting Software [Old Version] by Intuit, Inc. Platform: Mac Disc Change. And I really want.

For years, I used Quicken. It worked well on the Macintosh and had a ledger-looking interface that I loved.

When I bought a computer in 2008, it came, pre-installed, with Quicken 2005 for the Mac. However, when I bought another computer in 2012, I discovered that Quicken 2005 was no longer being supported. I was discouraged with the Quicken Essentials for Mac. Even the new, doesn’t do the trick for me. After poking around a couple years ago, I found. I am fairly satisfied with Moneydance, and while it isn’t as awesome as Quicken 2005, it is the closest thing I’ve found to it, and I still like it better than the new Quicken for Mac 2017. It’s not worth making the switch for me.

Moneydance Features. Price $49.99 Budgeting Bill Payment Investment Tracking Access Windows, Macintosh, iOS App, Android App Credit Score Monitoring Bill Management Retirement Planning Tax Reporting Reconcile Transactions Currency Support Multiple Custom Categories Two-Factor Authentication Import QFX, QIF Files Online Synchronization Promotions Expand All Features • Create a Budget — You can create a budget with the help of Moneydance. When you approach the limit in your categories, they show up orange to warn you that you are close. Another great feature of Moneydance is that you have a great home screen that helps you keep track of where you stand.

You can quickly see what you’ve spent so far in the month. It’s color-coded so that you can see which categories you are spending the most on. It’s a quick and easy way to see where you stand in the month, and it’s right there when you first open the software. • Bill Reminders — Schedule reminders to pay your bills.

I also use the feature that allows you to automatically enter transactions. That way, my automatic debit transactions are accounted for without a lot of thought from me. Moneydance also offers free billpay. This is one way that you can stay on top of what you owe — and when you owe it. Your upcoming bills are also represented on the home page when you open the software. There is also a handy list of bills that you owe off to the right, so that you can quickly click and see what you normally pay. Unfortunately, what’s listed is all bills past and present, so some of them might be items that you no longer pay, or that have changed.

• Extensions — Interestingly, Moneydance has a public API. You can use various extensions to further customize your experience. • Investment Support — You can also track your investment portfolio with Moneydance. Customize your options, and take advantage of the possibility of specific ID of shares so you can track tax lots.

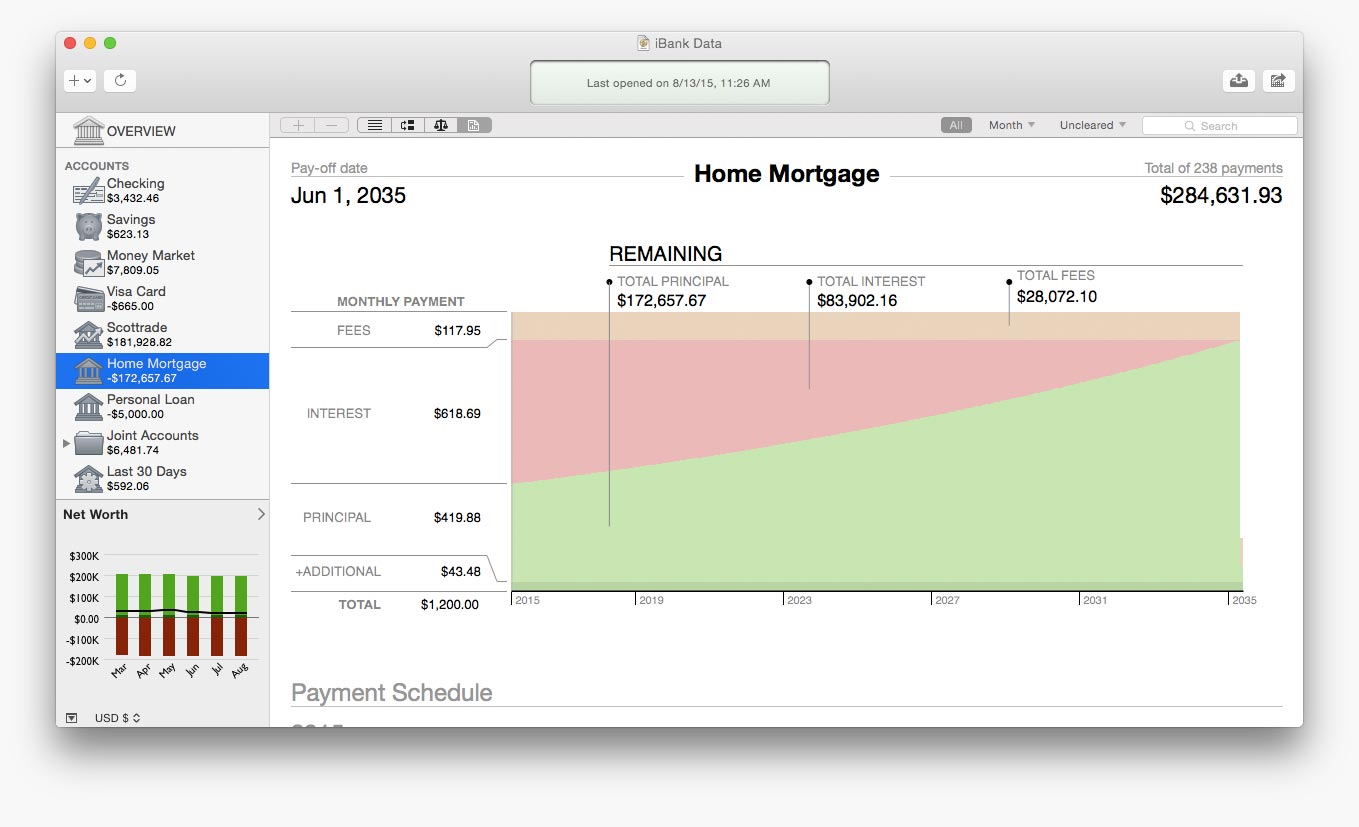

Moneydance can also be set to automatically download current prices. The software also helps you perform cost basis computations and stock splits computations. It’s a quick and easy way to stay up to date on what is happening with your investments. • Graphs and Reports — Generate a number of reports that can help you keep track of your spending in certain categories. You can also generate graphs and charts that let you see your entire financial picture. While Moneydance doesn’t have tax integration, it’s still possible to sort things by category. This is what I did in Quicken anyway, breaking out business expenses and other deduction categories.